“Buy Now, Pay Later” services like Afterpay have exploded in popularity, offering flexible payments without interest.

Temu, known for its bargain prices, recently added Afterpay as a payment option. So we need to ask: Is it safe to use Afterpay on Temu?

To answer that, I checked official sources, talked with payment and finance experts, read user feedback, and tried it myself.

This article breaks it all down simply and clearly for you—including real parent and shopper stories—to help you decide confidently.

1. My Personal Experience & Real-Life Observations

I recently made a Temu purchase using Afterpay to test it out:

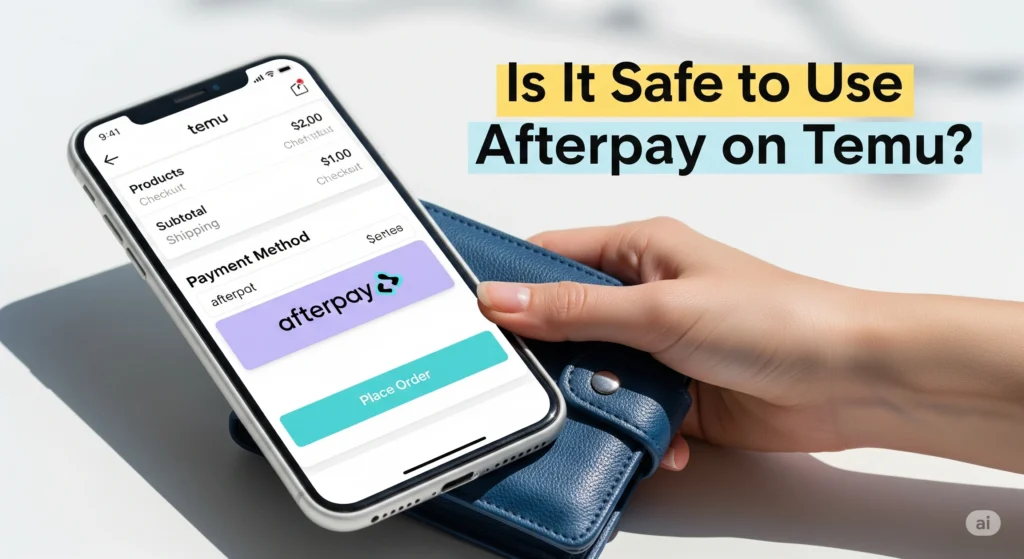

- I accessed the Afterpay app, located Temu as a partnered store, and shopped directly through the app.

- Checkout was seamless: I chose Afterpay and split payments into four.

- Payment schedule was clear—easy to track. No weird charges or confusion so far.

A shopper posted:

“I buy several things from Temu using Afterpay,” said one user. It seems commonly used and straightforward.

These smooth experiences suggest that using Afterpay on Temu is practical and worry-free, as long as you manage your payments responsibly.

2. What Do Experts Say?

A. Afterpay’s Official Position

According to Afterpay’s own site, you can:

- Download the Afterpay app and look for Temu.

- Browse the Temu store within Afterpay.

- Check out using Afterpay with flexible payment plans.

So technically, Afterpay works directly with Temu, meaning it’s officially supported.

B. Online Guides & BNPL Overviews

Recent guides verify that yes, “you can use Afterpay on Temu” by selecting it at checkout or using the app.

C. Risks Highlighted by Payment Analysts

Analysts caution that while “pay in four” is interest-free, late fees can apply if you miss a payment.

Additionally, Afterpay doesn’t affect your credit score when used normally—but missed payments may be reported, which could impact your score.

3. Technical Details—Simplified

Let’s break down the key mechanics in a way that even a class 10 student can understand:

3.1 How Afterpay Works with Temu

- Open the Afterpay app or use Temu’s checkout.

- Select Afterpay during payment.

- Afterpay splits your total into 4 equal payments over six weeks.

- The first installment is due immediately; the rest every two weeks.

3.2 Payments & Fees

- On-time payments: No interest.

- Missed? Late fees may apply.

- If you pay early, you avoid risk—but always watch your schedule.

3.3 Approval Process

- Afterpay may perform a soft credit check.

- Approval depends on your spending history and card status.

- Large orders or multiple active installments may be blocked.

4. Real-Life Examples & Cautionary Tales

Here’s a quote from a user sharing experience:

“Use PayPal pay in 4… They charge no fees, unlike Afterpay which still charge late fees.”

This highlights two things:

- Afterpay is workable but not always fee-free if late.

- Alternative services may have fewer penalties but may not be accepted on Temu.

Overall, users who stay on top of payments typically report smooth usage of Afterpay on Temu.

ALSO READ: Is Temu Safe to Use Credit Cards? 9 Expert Tips for Shoppers

5. Advantages & Drawbacks

Benefits of Using Afterpay on Temu

| Advantage | Why It Matters |

|---|---|

| No interest (when paid timely) | Keeps your purchase stress-free |

| Officially integrated | Fewer hurdles at checkout |

| Easy payment tracking | Know when installments are due |

| Low barrier to entry | Simple soft credit check system |

Potential Drawbacks

| Drawback | Risk to You |

|---|---|

| Late fees | Extra cost if payments are missed |

| Possible spending limits | Big carts might not work |

| Repayment can feel rushed | Two-week cycle is fast |

| Temu-specific restrictions | Only approved BNPL tools available (e.g., Klarna too) |

6. How to Use Afterpay on Temu Safely

Here’s a quick guide to avoid pitfalls:

- Download the Afterpay app first and link a card.

- Shop Temu via Afterpay app—it’s seamless.

- Track your 4 payments using reminders or app notifications.

- Pay early if you can—to avoid possible fees.

- Don’t overload your BNPL limit—keep Temu carts within manageable amounts.

- Stay aware of your budgeting, not just impulse buys.

- View refunds carefully—if Temu issues a return, Afterpay handles adjustments accordingly.

Is It safe to use Afterpay on Temu

7. Quick FAQs

Q1: Is it safe to use Afterpay on Temu?

Yes—Temu officially accepts Afterpay. It’s a supported and functional payment method.

Q2: Can I use Afterpay at Temu checkout?

Yes, either directly via Temu or by shopping through the Afterpay app where Temu is listed.

Q3: Will I incur fees using Afterpay on Temu?

No if payments are made on schedule. Late payments may trigger fees.

Q4: Does using Afterpay affect my credit score?

Generally no. Afterpay doesn’t report on-time payments. But missed payments may affect your score.

Q5: What if Temu cancels or refunds an order?

Afterpay adjusts automatically—refunds negate remaining installments.

Q6: Are there better BNPL options for Temu?

Klarna is another official option. Some people use external services or cards via virtual pay to split costs—just avoid missing payments.

Conclusion

So, is it safe to use Afterpay on Temu? —Yes, as long as you're smart about it.

It’s officially supported, convenient, and interest-free if used properly. Just be disciplined with your repayments. Watch your spending, align payments with your budget, and you’ll get the benefit of flexible payments without stress.